- 47shares

- 47

You’ve probably heard of the saying “Nothing is certain except death and taxes.” That’s right, we all have to know how to file taxes even if it is a frustrating job. Tax software is a special type of programs or services that will help you out with tax return.

You’ve probably heard of the saying “Nothing is certain except death and taxes.” That’s right, we all have to know how to file taxes even if it is a frustrating job. Tax software is a special type of programs or services that will help you out with tax return.

It’s not just about putting numbers on a sheet. There are dozens of different types of taxes – income, housing, child, unemployment, paid leave, etc. Each of them has to be calculated. Then you need to add deductions. How do I do my tax prep? How do I file my taxes? What if I already paid tax on unemployment? It is a very stressful task.

One miscalculation in tax preparation could mean big legal issues for months. But there is a way to make this process quick and painless. That is by using tax software!

We have picked and reviewed the best tax software in 2022 for you to help you with your tax preparation.

1. TurboTax – top choice of tax software

Intuit’s TurboTax is probably the best online tax filing software out there. It is used by millions of Americans every year to file their annual taxes.

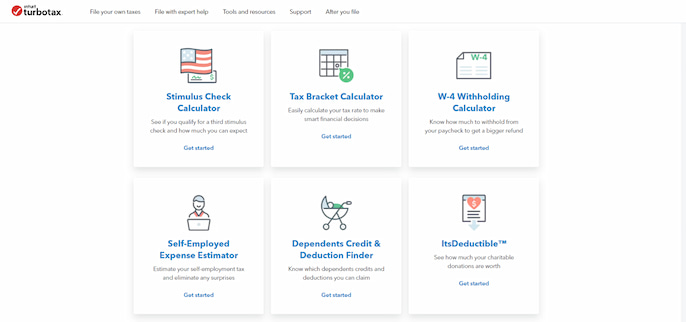

You can check out all the different features of TurboTax right on the website in your web browser. For instance, this tax preparation software allows you to calculate what tax brackets you are in, what kind of taxes you owe due to the stimulus checks, and various self-employment taxes.

A documents checklist enabled in this tax software ensures you haven’t forgotten or missed out on any important papers, such as a 1099 form for your small business or a W-4 form. TurboTax is indeed one of the best online tax filing options out there.

While this tax software is quite pricey, the ease of use is unmatched. It does not even feel like a tax calculation software. TurboTax will ask you various questions about your lifestyle and income sources. Simply answer them one by one, and at the end, it will pop out all the taxes, deductibles, and forms to submit.

OS: Web-based, Windows, MacOS

Licensing: Free; the subscription rates vary

Our Rating: 10 / 10

| Pros | Cons |

|

|

2. TaxSlayer – tax software with free unlimited support

TaxSlayer is the go-to option for those who want comprehensive yet professional tax software for calculation and filing, but can’t quite afford the premium price tag of TurboTax.

Don’t worry, though. TaxSlayer still includes almost all the features necessary in a tax software. You may calculate your overall tax, deductibles, tax return, and withholdings. You can get expert help as well, and see which forms of support TaxSlayer offers. Work your way through all the forms so you are not missing out on anything.

The free plan for this tax software includes a single free State Tax Returns filing. All other filings cost $39.95. The premium plans for TaxSlayer’s tools range from $24.95 to $54.95.

There are some caveats to the free version, such as having no dependents and a taxable income of less than $100,000. Even if you don’t fit these criteria, the overall pricing is very affordable.

OS: Web-based, Windows, MacOS, Chromebook, Kinux, Windows Mobile

Licensing: Free; the subscription starts at $24.95

Our Rating: 9 / 10

| Pros | Cons |

|

|

3. Jackson Hewitt — tax software from tax preparation company

Jackson Hewitt is well known as one of the biggest and best online tax filing service providers in the US. You may have heard of them from the physical side (the company) before. They have numerous physical locations where you can either walk in for assistance or mail your tax papers to.

However, Jackson Hewitt also now features an online tax filing platform. This tax software has the most comprehensive guidance available. They offer the same services online as they do offline, so expect top-notch customer service and tax guidance from experienced accountants.

On first log-in to this tax return service, you will be asked to give all your financial, personal, and business details. Jackson Hewitt will use this info in order to generate your taxes and highlight which forms you need to file.

OS: Web-based

Licensing: Free; the tax filing options start at $29.99

Our Rating: 9 / 10

| Pros | Cons |

|

|

4. Credit Karma Tax – tax software with great integration feature

Some people balk at the idea of free tax preparation. Considering most free tax software usually gives a subpar experience, can you really want to trust your taxes to one?

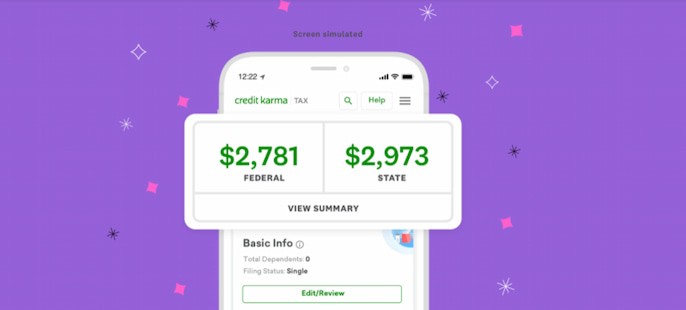

Yes, you can! Credit Karma is well known as one of the best free tax software. It is also very easy to use. All you have to do is enter your details. The tax preparation software will use its

Smart Filing features to tell you exactly what you need to file.

Plus, it offers bonus features like audit defenses and guarantees the max returns.

In fact, if you get a higher return by calculating manually or using another tax software, Credit Karma will actually refund you the difference.

It also has a function for switching from other tax services like TurboTax or H&R Block. If you used one of those previously and want to switch to tax software with a more moderate payment rate, Credit Karma Tax is the way to go.

OS: Web-based

Licensing: Free

Our Rating: 8 / 10

| Pros | Cons |

|

|

5. H&R Block – professional tax software

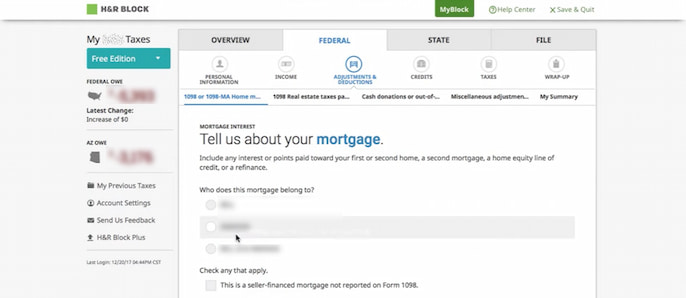

H&R Block is considered by many to be the best tax software for self-employed and small businesses. This tax preparation service is packed full of features that will help you file your taxes quickly and correctly.

H&R Block is cloud-based, but it can also be downloaded for offline work. Like most others, this tax software guides the user through filing taxes by surveying them. Then it will explain which forms to fill and which taxes to calculate.

And if you don’t want to do all of this yourself, you can simply upload your documents and let a professional who knows how to file taxes from A to Z handle the rest. The professional will check if everything is correct, then file it with the relevant authorities. Always make sure the websites you visit work under HTTPS protocol.

H&R Block is no free tax preparation and does come with a notable price tag. It starts at $29.95 for basics and goes up to $89.95 for premium and small-business taxes.

OS: Web-based, Windows, MacOS, iOS, Android

Licensing: Free

Our Rating: 8 / 10

| Pros | Cons |

|

|

This is our list of the top tax preparation software for professionals. Whichever needs you have, one of these tax services will definitely help you file your taxes accurately and on time. If you’re all about money saving then our article on giveaway websites might be suitable for your further reading.